Start Your Quote for Equipment Breakdown Insurance

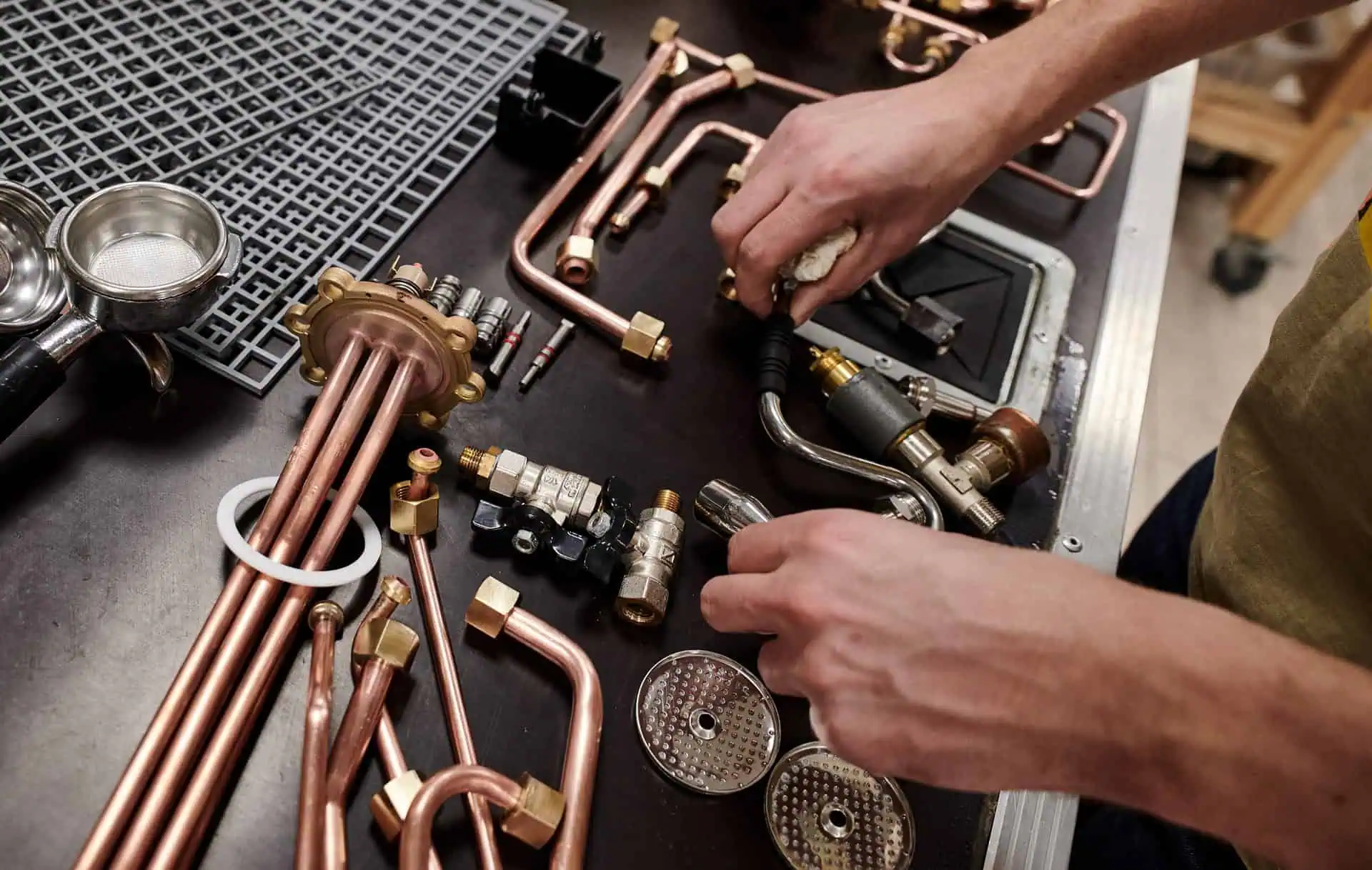

Running a business means relying on machinery and equipment every day. From HVAC systems to production machinery, a sudden breakdown can halt operations and lead to unexpected expenses. At Jenkins Insurance & Financial Services, we help businesses across Virginia secure Equipment Breakdown Insurance that keeps operations running smoothly. Our coverage may include repairs, replacements, and even business interruption protection to give you peace of mind.

Whether you operate a small shop or a large industrial facility, our team works with you to understand your unique needs and create a tailored insurance solution. With years of experience serving Virginia businesses, we combine local knowledge with national insurance resources to provide coverage that truly protects your bottom line.

What Is Equipment Breakdown Insurance And Why Do Virginia Businesses Need It?

Equipment Breakdown Insurance is designed to cover the costs when essential business equipment fails unexpectedly. Unlike standard property insurance, which may not cover mechanical or electrical malfunctions, equipment breakdown coverage steps in when boilers, HVAC systems, refrigeration units, or production machinery fail.

For Virginia businesses, these failures can be costly. Repairs or replacements may be expensive, and downtime can affect productivity and revenue. Equipment Breakdown Coverage may include costs for repairing damaged equipment, replacing it if necessary, and even covering the resulting business interruption losses. By securing this coverage, businesses in Virginia can avoid the financial shock of unexpected breakdowns and keep operations moving efficiently.

Client Reviews

Why Should I Choose Jenkins Insurance & Financial Services For Equipment Breakdown Coverage In Virginia?

Choosing the right insurance partner is as important as the coverage itself. Jenkins Insurance & Financial Services has deep experience helping Virginia businesses secure Equipment Breakdown Insurance that meets their specific needs. Our approach combines professional guidance, personalized solutions, and responsive service.

We take the time to understand your operations, identify risks, and explain your options in clear, practical terms. Our policies may include flexible coverage features, fast claims handling, and proactive risk management strategies. With Jenkins Insurance & Financial Services, Virginia businesses can operate with confidence, knowing their critical equipment is protected and that support is just a call away.

How Can I Get Started With Equipment Breakdown Insurance Today?

Getting started is simple. Contact Jenkins Insurance & Financial Services to discuss your business and equipment needs. We’ll help you assess risks, understand coverage options, and obtain a quote tailored to your operations.

Our friendly, knowledgeable team guides Virginia businesses through the entire process, making it easy to secure Equipment Breakdown Coverage that fits both your budget and your risk profile. With our support, you can focus on growing your business, knowing that unexpected equipment failures won’t disrupt your plans or finances.

Get a Quote

Get a personalized quote! Share your details and a friendly agent will be in touch.