Start Your Quote for Land Insurance

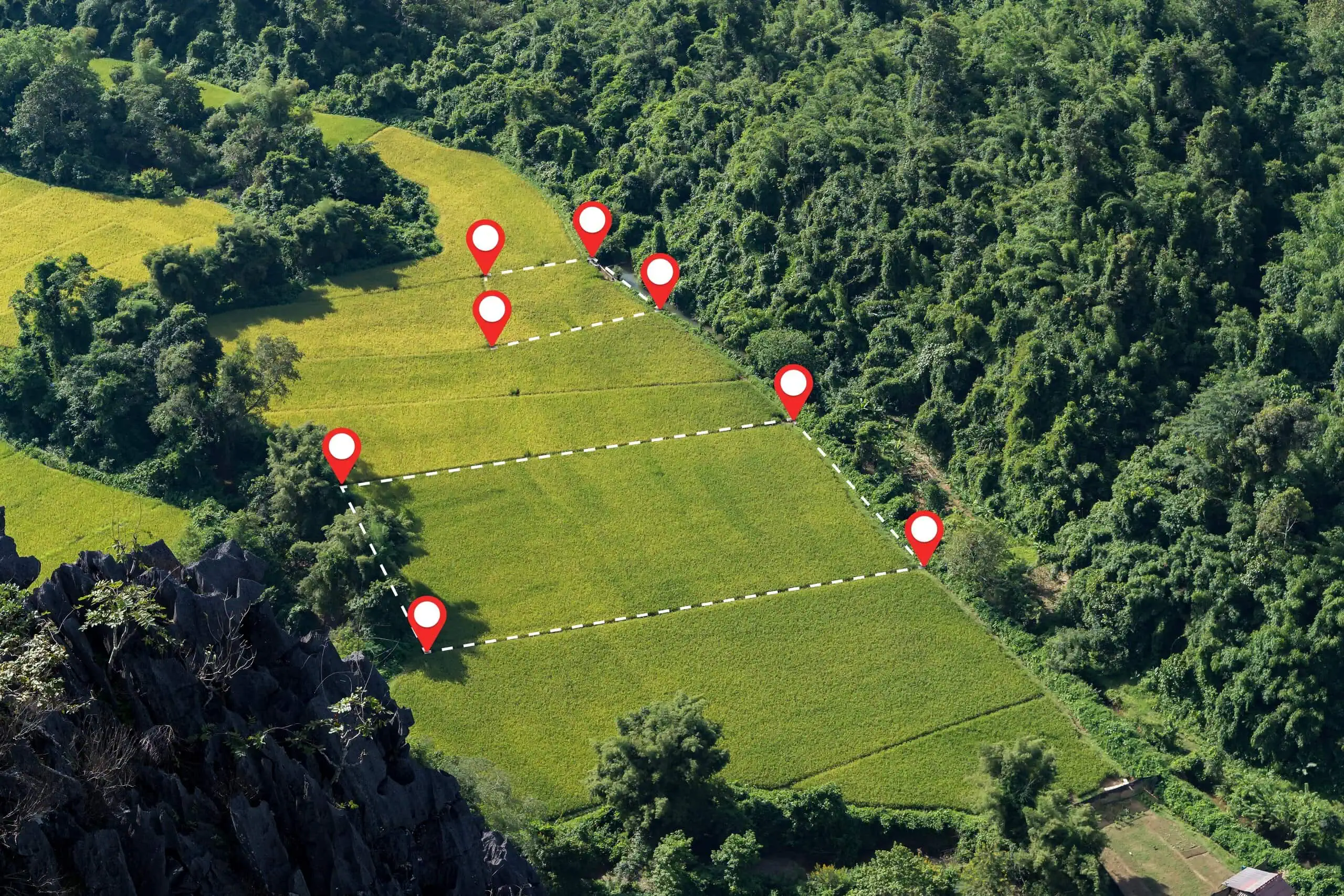

Owning land in Virginia can be a valuable investment, whether you use it for recreation, future development, or simply to hold as an asset. Protecting that property from potential risks is important. At Jenkins Insurance & Financial Services, we provide options for land insurance and vacant land insurance tailored to Virginia property owners.

What Is Land Insurance?

Land insurance is a type of coverage designed to help safeguard your financial interest in a piece of property. In Virginia, this can apply to rural acreage, undeveloped parcels, or lots awaiting construction. Policies may address a variety of concerns, from accidental injuries that occur on the property to certain types of property damage. The details can vary, so it is important to review the specific terms offered by an insurer.

Client Reviews

What Makes Jenkins Insurance & Financial Services Different?

Our agency works with Virginia landowners to find insurance options that suit their unique properties. We take into account the size, location, and use of the land, then connect clients with carriers offering policies that fit those needs. By focusing on both land insurance and vacant land insurance, we are able to help a variety of property owners, from those holding investment lots to those maintaining recreational acreage.

As a Virginia-based agency, we understand the local landscape, from the Blue Ridge Mountains to the coastal plains. We also recognize that each piece of land has its own story and purpose. Our role is to help you find coverage that aligns with your goals and circumstances, without unnecessary complexity. We believe in providing clear explanations, straightforward guidance, and personalized service.

How Can You Get Started Protecting Your Land?

If you own land in Virginia, whether vacant or in use, the first step is understanding the potential risks and the insurance options available. At Jenkins Insurance & Financial Services, we make the process simple. We gather the necessary details about your property, review the available coverage choices, and provide information so you can make an informed decision. Contact us today to get started!

Get a Quote

Get a personalized quote! Share your details and a friendly agent will be in touch.